By: Editors

No matter how much money you have, it is never enough. This leaves individuals and organizations alike saddled with a difficult dilemma. On the one hand, acquisition of any amount of money is prized, while on the other hand, money remains ephemeral and unchecked spending can quickly deplete your resources. In this challenging landscape, good money management skills become absolutely essential.

The first step in financial mastery is setting a budget. By carefully creating and documenting a spending plan, individuals and organizations can more easily monitor their finances and create systems for managing their money.It is also critical to prioritize spending and set aside money for saving and eliminating debt. Establishing a baseline budget is a sprawling task that requires a commitment to research, preparation, and routinely updating of financial records.

The second core component of money management is to carefully track spending. This process involves creating separate budgetary accounts for different expenses and creating a system for tracking gains and losses. While tracking spending does require extra effort, it pays off greatly in terms of ensuring that one is aware of their financial situation at all times. Additionally, tracking spending on different items can also help individuals and organizations identify lessons to use for future budgeting and investments.

The third step in money management is generally focused on long-term plans and investments. Though many are anxious to spend their hard-earned money, prudence suggests that some be set aside for the future. Investment planning should involve careful consideration of a wide range of factors, including risk management, portfolio diversification, and other preventive measures. Moreso, individuals and organizations must judge their time horizons and the types of investments they are comfortable with. Though these calculations require effort, they are essential for ensuring long-term financial health.

Finally, money management requires access to reliable solutions for monitoring and managing accounts and investments. Different people have different methods for this task, but it is important to understand the costs and benefits of any system. We may wish to research solutions that use mobile apps and technology for creating a comprehensive view of their finances.

Money management involves more than simply tracking the outflow and inflow of money. A successful financial system requires discipline, planning, and wise investment. Though it is difficult to set aside money for the future, it is ultimately the key to having enough funds to meet everyday needs. By acquiring financial management skills, individuals and businesses can ensure they are well prepared for whatever the future may bring.

Ibeh Ugochukwu Bonaventure on Troco Technology: Building Trust Where Nigerians Once Took Risks

Ibeh Ugochukwu Bonaventure on Troco Technology: Building Trust Where Nigerians Once Took Risks  Funnyfreakc Opens Up To Irodili: 5 Secrets Behind His Comedy Rise

Funnyfreakc Opens Up To Irodili: 5 Secrets Behind His Comedy Rise  2025: A Defining Year of Global Impact for Amb. Dr. Jamezany James in Pan-African Cultural Diplomacy

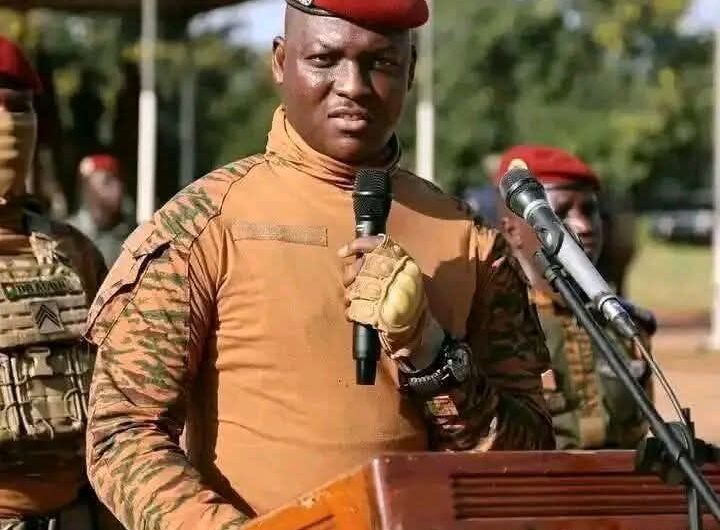

2025: A Defining Year of Global Impact for Amb. Dr. Jamezany James in Pan-African Cultural Diplomacy  AfricaWorld Man of the Year 2025: Ibrahim Traoré, Positive Defiance

AfricaWorld Man of the Year 2025: Ibrahim Traoré, Positive Defiance  One-on-One with Peter Armand Boyo: The Lion Who Tells His Own Story. The Pan-African actor, filmmaker, and cultural advocate reflects on African storytelling, cinema, and identity on the global stage.

One-on-One with Peter Armand Boyo: The Lion Who Tells His Own Story. The Pan-African actor, filmmaker, and cultural advocate reflects on African storytelling, cinema, and identity on the global stage.  TC Wanyanwu Breaks Silence: 30 Hard-Hitting Questions on Jesus is a Black Man Answered by the Author in Exclusive Interview with Pan-African Journalist Mr. Irodili

TC Wanyanwu Breaks Silence: 30 Hard-Hitting Questions on Jesus is a Black Man Answered by the Author in Exclusive Interview with Pan-African Journalist Mr. Irodili  Onitsha Market Closure: Soludo Explains Rationale, Vows to End Sit-at-Home

Onitsha Market Closure: Soludo Explains Rationale, Vows to End Sit-at-Home  FIFA Rules Out World Cup Ban as Senegal Face CAF Sanctions Over AFCON Final Walk-Off

FIFA Rules Out World Cup Ban as Senegal Face CAF Sanctions Over AFCON Final Walk-Off  Nollywood Actress, Angela Okorie Reportedly Detained Over Alleged Cyberbullying Linked to Mercy Johnson Case

Nollywood Actress, Angela Okorie Reportedly Detained Over Alleged Cyberbullying Linked to Mercy Johnson Case  FCT Strike Persists as Workers Ignore Court Order, Keep Pressure on Wike

FCT Strike Persists as Workers Ignore Court Order, Keep Pressure on Wike