By Ollus Ndomu

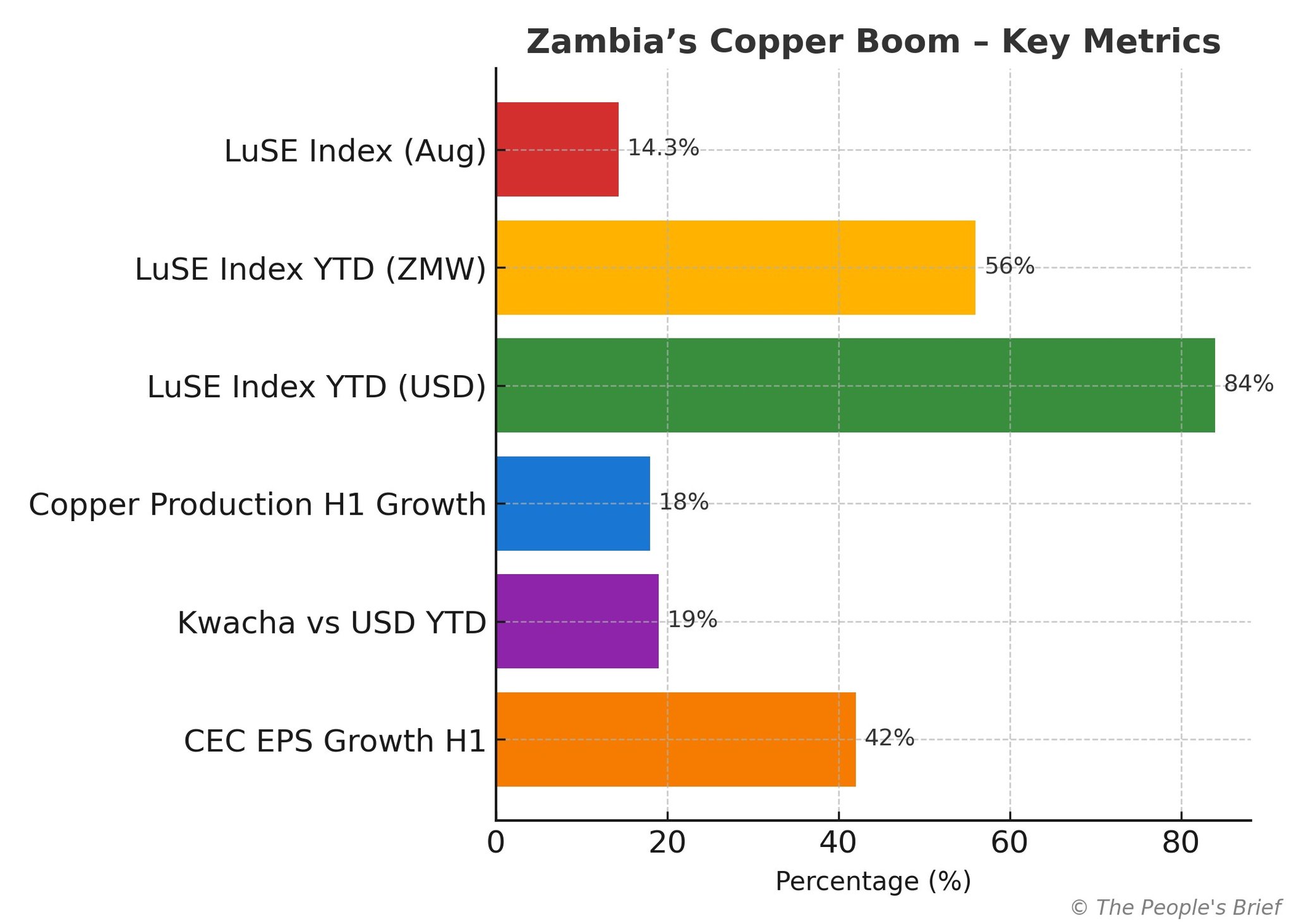

Zambia has emerged as one of the world’s most closely watched economies, riding a wave of investor optimism powered by copper and capital market gains. The Lusaka Securities Exchange (LuSE) has surged to the top of global rankings, with Bloomberg data showing its All Share Index climbing 14.3% in August alone. Year-to-date, the index is up nearly 56% in kwacha terms and an astonishing 84% in dollars, outpaced only by Ghana.

Copper at the Core

The engine of this momentum is copper, the red metal that defines Zambia’s economy. First-half production rose 18% to 439,644 metric tons, and government has set its sights on a record one-million tons before the year ends. On the London Metal Exchange, copper prices have held firm at around $9,818 per ton.

📌 Fact Box: Copper accounts for more than 70% of Zambia’s export earnings. Every increase in output or price fuels the kwacha, the stock market, and investor sentiment.

A Billion-Dollar Milestone

Copperbelt Energy Corporation (CEC), the private utility that powers the country’s mines, has become the emblem of this rally. Its share price has jumped more than 75% in 2025, cementing its status as the first Zambian-listed company to surpass $1 billion in market value.

CEC has projected a 42% rise in first-half earnings per share, a sign of the critical link between energy supply and mining output. Investors have rewarded this performance, propelling LuSE into record-breaking territory.

The Currency Effect

The kwacha is also riding high. In 2025 it has appreciated 19% against the dollar, ranking among the best-performing currencies globally. Analysts tie this rally to copper receipts and progress on Zambia’s long-delayed sovereign debt restructuring.

A stronger kwacha has eased the burden of imports, lowering costs for essentials like fertilizer and fuel. Bondholders have also taken comfort, interpreting the rally as proof of macroeconomic stability. Yet questions remain over durability: can Zambia sustain these gains once global commodity cycles turn?

Stocks and Society

The stock market boom makes headlines abroad, but its real test lies at home. For ordinary citizens, the impact is not yet felt in household budgets. Food remains expensive, transport costs are high, and access to affordable credit is still limited.

“A rising index must mean more than rising wealth for shareholders. The ultimate measure is whether Zambians see relief in their daily lives.”

Will the copper windfall finance new schools and hospitals, or will it evaporate as in past booms? That is the challenge confronting policymakers.

Policy Challenge

Zambia has lived through copper booms before. They lifted GDP and reserves, but poor fiscal management and over-reliance on one commodity left the economy vulnerable. The difference this time is reform. Debt restructuring is underway, the energy sector is liberalizing, and mining policy is stabilizing.

Still, reforms are fragile. They require strict fiscal discipline, transparent governance, and investments that expand agriculture, manufacturing, and renewable energy. Without diversification, the country risks repeating old cycles of growth and collapse.

Regional Signal

Zambia’s surge is resonating across Africa. With Ghana and Zambia leading the world’s stock markets in 2025, investors are closely watching how commodity exporters manage their windfalls. Will these countries turn temporary commodity gains into long-term stability? Or will they remain hostage to global price swings?

For Zambia, this is not just a domestic story. Its performance sends a message that African economies, if reformed and well-managed, can command global attention and capital inflows.

The Bottom Line

Zambia’s copper boom is real and its fundamentals strong. Record production, a resurgent currency, and a stock market outpacing global peers show the potential for transformation. Yet numbers on a chart are not the end goal.

The country’s future will be defined by whether leaders can turn windfalls into tangible progress. If copper’s wealth builds classrooms, powers hospitals, and creates jobs, then this boom will stand apart from those that came before it. If not, history may once again repeat itself.