By: Chioma Madonna Ndukwu

Nigerians Not Required To Get Separate TIN For Bank Accounts — FIRS

The Federal Inland Revenue Service (FIRS) has assured Nigerians that they do not need to obtain a separate Tax Identification Number (TIN) to open or operate bank accounts.

The clarification comes after reports circulated claiming that from January 2026, bank customers would be compelled to present a TIN before accessing banking services. The claims sparked public concern about possible new hurdles in the financial system.

In response, Aderonke Atoyebi, Technical Assistant on Broadcast Media to the FIRS Chairman, described the reports as misleading.

Writing on her official X handle, she explained that Nigeria’s tax identification system is already linked with existing national databases such as the National Identification Number (NIN) for individuals and Corporate Affairs Commission (CAC) records for companies.

According to her, this integration ensures that every eligible person or entity can automatically be identified for tax purposes without the need for additional paperwork.

She further explained that the TIN is a 13-digit number that captures key details of taxable individuals and organizations, including the year of issuance, source of registration, state of registration, and a cryptographic security code.

By linking the system with existing registries, the FIRS says it aims to simplify tax administration and reduce duplication, ensuring that banking services remain accessible without new requirements.

Kim Signals Willingness for Talks if US Drops “Denuclearisation Obsession”

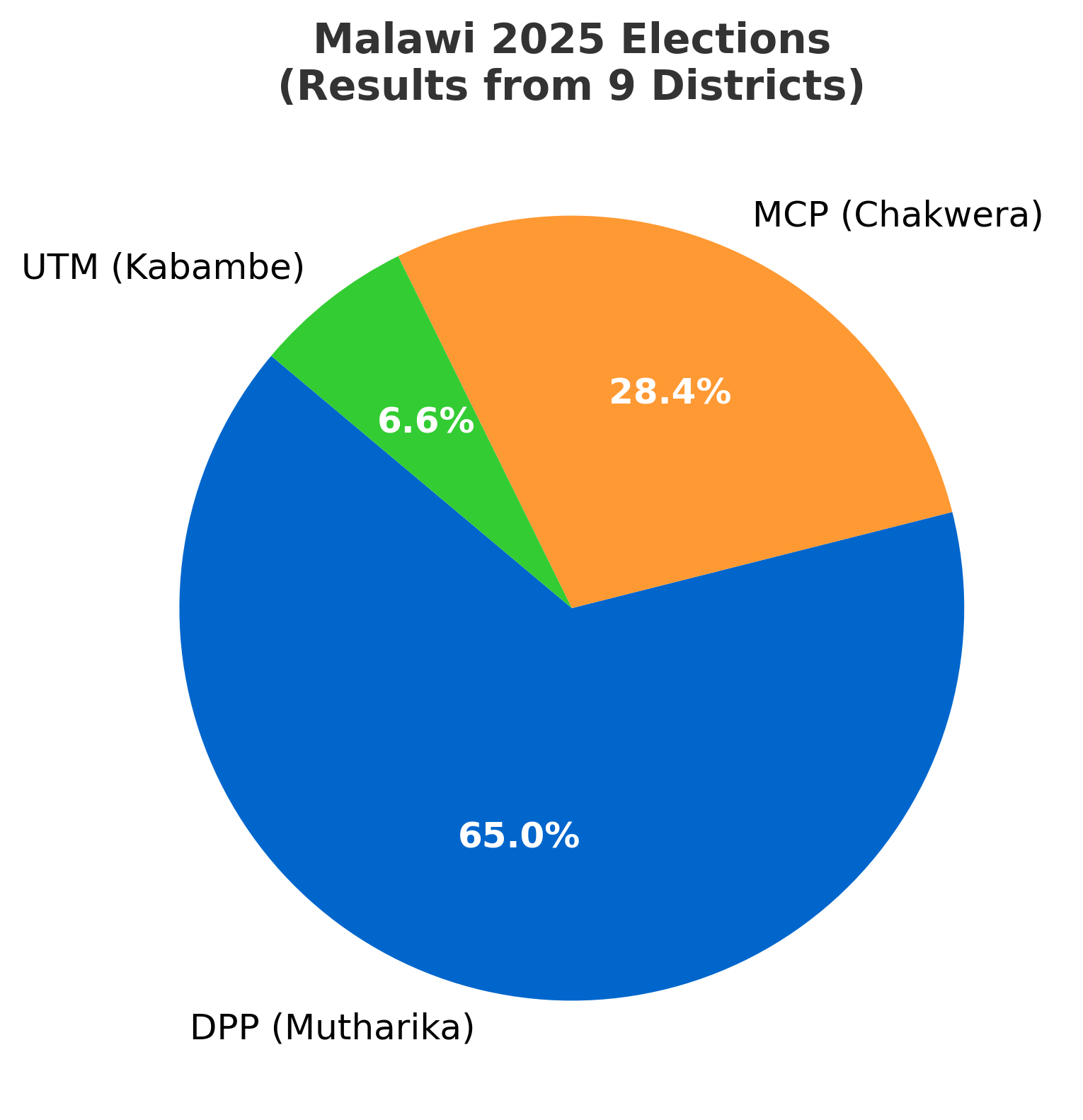

Kim Signals Willingness for Talks if US Drops “Denuclearisation Obsession”  Malawi On Edge as Mutharika Pulls Ahead, MCP Alleges Fraud

Malawi On Edge as Mutharika Pulls Ahead, MCP Alleges Fraud  Nigeria : Chef Hilda Baci and the Recent held Abuja Cooking Festival

Nigeria : Chef Hilda Baci and the Recent held Abuja Cooking Festival  Vice-President Riek Machar Accused of Murder, Treason, and Crimes against humanity

Vice-President Riek Machar Accused of Murder, Treason, and Crimes against humanity  Larry Ellison Becomes World’s Richest Person, Overtakes Elon Musk

Larry Ellison Becomes World’s Richest Person, Overtakes Elon Musk  Burkina Faso, Mali and Niger Plan Joint Development Bank, Stirring CFA Franc Debate

Burkina Faso, Mali and Niger Plan Joint Development Bank, Stirring CFA Franc Debate  Women’s Groups Take Natasha Akpoti-Uduaghan Case to UN

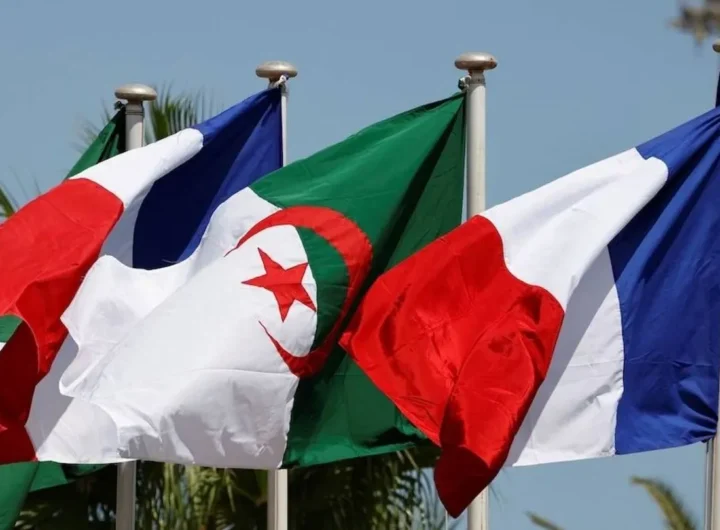

Women’s Groups Take Natasha Akpoti-Uduaghan Case to UN  Algeria Stops Visa-Free Entry for French Diplomats

Algeria Stops Visa-Free Entry for French Diplomats  Civilians Killed in Fresh Attack on Mozambique Port Town

Civilians Killed in Fresh Attack on Mozambique Port Town  US Warns Nigerian Politicians Over Corruption, Issues Visa Ban Threat

US Warns Nigerian Politicians Over Corruption, Issues Visa Ban Threat