By : Chinasaokwu Helen Okoro

Precious Metals Rally as Markets Seek Shelter Amid Geopolitical Shockwaves

Gold, Silver Prices Rise on Geopolitical Jitters After Reports of U.S. Move Against Venezuela’s Maduro

Global precious metals markets surged on heightened risk aversion after reports of a dramatic escalation in U.S.–

Venezuela tensions sent investors scrambling for safe-haven assets. Gold and silver prices climbed sharply as traders weighed the geopolitical and economic implications of reports that U.S. forces had captured—or were in the process of securing—Venezuelan President Nicolás Maduro, a development that, if confirmed, would mark one of the most consequential interventions in Latin America in decades

Spot gold rose steadily in early trading, extending gains as demand intensified across Asian and European sessions. Silver followed suit, outperforming gold on a percentage basis as speculative interest returned to the metal metal often seen as both a monetary hedge and an industrial commodity.

Analysts said the rally reflected a familiar pattern: when geopolitical uncertainty spikes, investors tend to rotate away from risk assets and toward stores of value.

“Any event that introduces uncertainty into global politics—especially involving energy-producing regions—tends to be bullish for precious metals,” said a commodities strategist at a London-based brokerage.

“Markets are reacting not just to the headline, but to the unknowns that follow.”

The reported U.S. action against Maduro, whose government has long been under American sanctions, reignited fears of broader regional instability.

Venezuela holds some of the world’s largest proven oil reserves, and even the perception of upheaval has implications for energy markets, inflation expectations, and currency volatility.

Those concerns helped underpin gold’s appeal as a hedge against both geopolitical risk and potential inflationary spillovers.

Equity markets were mixed as investors digested the news. While defense and energy stocks found support, broader indices showed signs of caution. Emerging market currencies, particularly in Latin America, came under pressure amid fears of contagion effects and capital flight.

The U.S. dollar traded unevenly, initially strengthening on safe-haven flows before easing as traders assessed the longer-term implications.

Silver’s rally was amplified by thin liquidity and renewed interest from retail investors, some of whom view the metal as undervalued relative to gold. The gold–silver ratio narrowed slightly, reflecting silver’s stronger performance. “Silver tends to move faster in moments like this,” noted a market analyst in New York.

“It’s more volatile, and when fear hits, that volatility cuts both ways—but today it’s clearly to the upside.”

Beyond immediate price action, the episode underscored the fragile state of global geopolitics at a time when markets are already grappling with elevated interest rates, slowing growth in parts of the world, and ongoing conflicts elsewhere. Central banks, particularly in emerging economies, have been increasing their gold reserves in recent years, a trend that some analysts say could accelerate if geopolitical tensions continue to mount.

Traders cautioned, however, that precious metals markets remain sensitive to confirmation—or denial—of the initial reports.

Any clarification that reduces uncertainty could prompt profit-taking, while further escalation would likely extend the rally. “Gold thrives on uncertainty,” the London strategist added.

“The more opaque the situation, the stronger the bid.”

For now, the jump in gold and silver prices reflects a market on edge, bracing for potential ripple effects across energy supplies, diplomatic relations, and global financial stability.

Whether the move proves to be a short-lived spike or the start of a more sustained safe-haven rally will depend on how events in Venezuela—and Washington—unfold in the days ahead.

Unstable Power Supply Affects Service Delivery in Osun PHCs — Report

Unstable Power Supply Affects Service Delivery in Osun PHCs — Report  Hadiza Kuta endorses maritime journalists’ visit, award to Oyebamiji

Hadiza Kuta endorses maritime journalists’ visit, award to Oyebamiji  2025: A Defining Year of Global Impact for Amb. Dr. Jamezany James in Pan-African Cultural Diplomacy

2025: A Defining Year of Global Impact for Amb. Dr. Jamezany James in Pan-African Cultural Diplomacy  Against Fixed Meaning: Nicholas Ravniker in Conversation with Irodili on Attention, Difficulty, and Letting Language Lead

Against Fixed Meaning: Nicholas Ravniker in Conversation with Irodili on Attention, Difficulty, and Letting Language Lead  Organisation to launch smartphone initiative to revive students’ reading culture

Organisation to launch smartphone initiative to revive students’ reading culture  The Pulse of West Africa: Why Youth Look to Captain Ibrahim Traore

The Pulse of West Africa: Why Youth Look to Captain Ibrahim Traore  Burkina Faso Junta Says Assassination Plot Against Leader Has Been Foiled

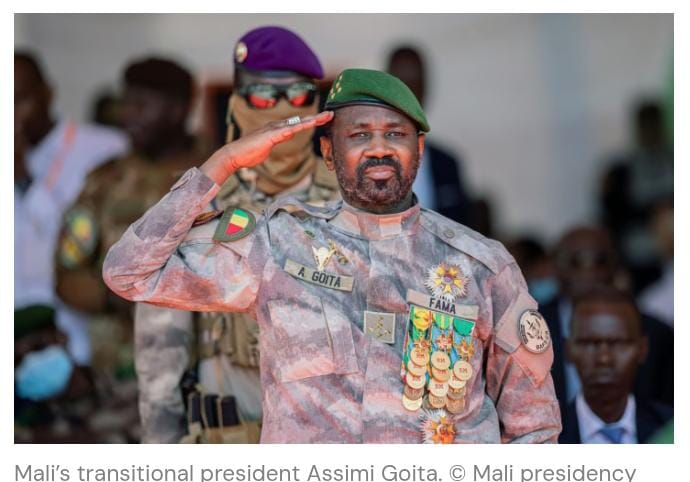

Burkina Faso Junta Says Assassination Plot Against Leader Has Been Foiled  Assimi Goïta’s Latest Military Purge Shakes

Assimi Goïta’s Latest Military Purge Shakes  Precious Metals Rally as Markets Seek Shelter Amid Geopolitical Shockwaves

Precious Metals Rally as Markets Seek Shelter Amid Geopolitical Shockwaves